Calculate tax on item

An ad valorem tax Latin for according to value is a tax whose amount is based on the value of a transaction or of property. The Salvation Army does not set a valuation on your donation.

4 Formas De Calcular El Impuesto Sobre Las Ventas

The land item must appear on the assessment as 100 per cent owned.

. Paying land tax at settlement via an Electronic Lodgment Network Operator ELNO You can pay land tax by BPAY during settlement via an approved ELNO. Net worth is the amount by which assets exceed liabilities. Tax rate data requirements.

Customize your tax calculation solution to pay for whats right for your business. Finally divide the gross price by the sales tax rate plus one. State and local governments across the United States use a sales tax to pay for things like roads healthcare and other government services.

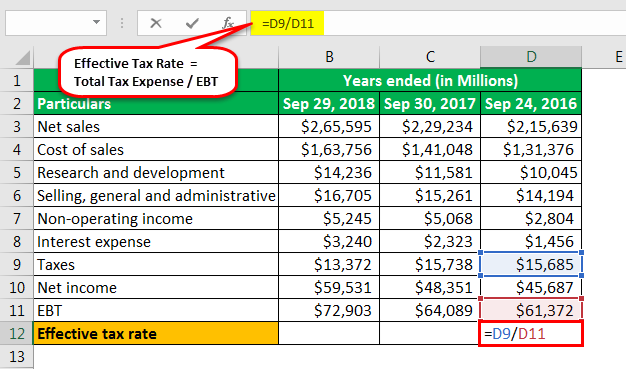

Ie EBT Net income Total tax expense. Check Out Our Free Newsletters. The deferred tax represents the companys negative or positive amounts of tax owed.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021. Shipping rate data requirements. The UNs SDG Moments 2020 was introduced by Malala Yousafzai and Ola Rosling president and co-founder of Gapminder.

Go to IRSgovOrderForms to order current forms instructions and publications. Read more grew from 35000 in 2016 to 50800 in 2018 and Pretax Income from 3000 in 2016 to 4000 in. Next determine the net income of the corporation which will also be available as a line item in the income statement.

Then multiply the resulting number by the list price of an item to figure out the sales tax on that item. For example you may have a local tax or an additional tax on specific items. Tax Preference Item.

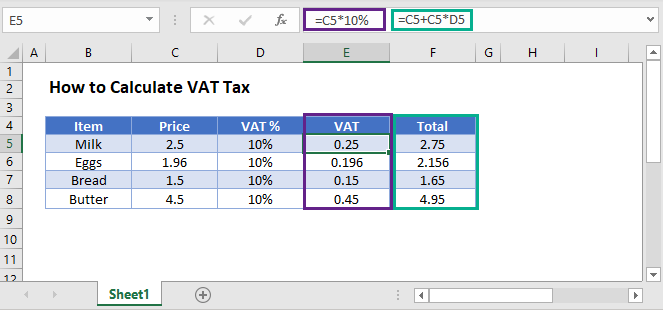

The EBT can be calculated by adding the total tax expense to the net income. For example if the price price attribute is set to 3 USD unit pricing. The tax liability is calculated by adjusting the accounting income as per income tax laws.

Add 100 percent to the sales tax rate. Again there may be more than one district tax applied to the sales tax in a given area. Free tools for a fact-based worldview.

The 100 percent represents the whole entire pre-tax price of the item in question. The IRS will process your order for forms and publications as soon as possible. Next find the current local governments tax rate and the property tax.

The sales tax formula is simply the sales tax percentage multiplied by the price of the item. Add those values together to get the total value. Sales taxes can also be referred to as retail excise or privilege taxes depending on the state.

Used by thousands of teachers all over the world. As evident from the above figures Net Revenues Net Revenues Net revenue refers to a companys sales realization acquired after deducting all the directly related selling expenses such as discount return and other such costs from the gross sales revenue it generated. Word that describes a product once its been added to your product data either in a text feed XML feed or API.

In all tax rates in California range from 75 percent. Sales tax is a tax that is paid to a tax authority for the sale of goods and services. Only 1 left in stock - order soon.

The seller has the obligation to remit the tax to the proper tax agency within a prescribed period. An ad valorem tax may also be imposed annually as in the case of a real or personal property tax or in connection with another significant event eg. Net worth is a concept applicable to individuals and businesses as a key measure of how much an entity is worth.

Cost of Goods Sold - COGS. Please choose a value within this range that reflects your items relative age and quality. It includes low and high estimates.

A type of income normally tax-free that may trigger the alternative minimum tax AMT for taxpayers. Or sale price if active is used to calculate the unit price of the product. Calculate the tax rate if his total income tax payable as per IT filing is 45000.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Our innovative cloud-based sales tax calculation program AvaTax determines and calculates the latest rates based on location item legislative changes regulations and more. Use AvaTax to automatically calculate rates for the following types of taxes.

Youd multiply 2795 by 08 giving you a sales tax amount of 224. Every day get fresh ideas on how to save and make money and achieve your financial goals. So lets say youre buying something that costs 2795 with a local tax rate of 8.

Call 800-829-3676 to order prior-year forms and instructions. Deferred tax is a balance sheet line item recorded because the Company owes or pays more tax to the authorities. Cost of goods sold COGS is the direct costs attributable to the production of the goods sold in a company.

Add that amount to the price of the item to find your total cost with tax. Windows 81 10. Turbotax Deluxe State 2019.

HR Block Tax Software Premium 2021 with 3 Refund Bonus Offer Amazon Exclusive PC Download by HR Block. District tax rates range from 01 to 1 percent and are added to the state sales tax rate as a surtax. For example income profit before tax of ABC Ltd.

So if the sales tax in. You can get forms. Dont resubmit requests youve already sent us.

A consistent increase. The Donation Value Guide below helps you determine the approximate tax-deductible value of some of the more commonly donated items. Convert the percentage to a decimal -- so 7 becomes 007.

A tax expense is a liability owing to federal stateprovincial and municipal governments. Sales tax applies to most consumer product purchases and exists in most states. Tax expenses are calculated by multiplying the appropriate tax rate of an individual or.

Tax preference items include private-activity municipal-bond interest. To clear the land tax on or before settlement youll need one of the following documents. This amount includes the cost of the materials used in.

Concept of Deferred Tax. It is typically imposed at the time of a transaction as in the case of a sales tax or value-added tax VAT. Ordering tax forms instructions and publications.

When you add it to the tax rate you get a total percentage that represents the pre-tax price plus the tax. Section 179 deduction dollar limits. To calculate property tax find out the value of the land and the value of whatever is built on the land by contacting your local assessors office.

So to calculate income tax on this income the income is adjusted for various adjustments like disallowance of some expenses as per IT law. Deferred income taxes impact the companys future cash flow ie if its an asset the cash outflow will be less and if its a liability. Sales tax is paid by the buyer and is collected by the seller.

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Sales Tax Calculator

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Sales Tax In Excel

Effective Tax Rate Definition Formula How To Calculate

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax For Your Online Store

Reverse Sales Tax Calculator

How To Calculate Taxes And Discounts Basic Concept Formulas And Examples Cuemath

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

How To Calculate Find The Sales Tax Rate Or Percentage Formula For Calculating Sales Tax Rate Youtube

How To Calculate Vat Tax Excel Google Sheets Automate Excel

Effective Tax Rate Formula And Calculation Example

How To Calculate Sales Tax In Excel

Sales Tax Calculator